August of Accountability: Republicans’ Actions in July Are Causing Insurance Rates to Skyrocket

08.06.2025

As Insurers Release Their Proposed Rates in All 50 States, Consumers to Face Shocking Premium Hikes

The Republican health care cuts signed into law by President Trump this summer will have devastating consequences for working families across the country next year when health care costs are expected to skyrocket. Republicans cut $1 trillion from our health care system and opted to make tax breaks for billionaires and big corporations permanent while allowing tax credits that help working families afford their health insurance premiums to expire this year. These and other changes will cause health care premiums and costs to spike for everyone, whether you get your health care through Medicaid, your employer, or on the private insurance market.

This month, the Centers for Medicare & Medicaid Services has released proposed premium rate increases for insurers across all 50 states. The proposed rates paint a dire picture of the cost of health care in America moving forward, as insurers pass on expenses to consumers related to the health care cuts, and increased hospital prices and utilization.

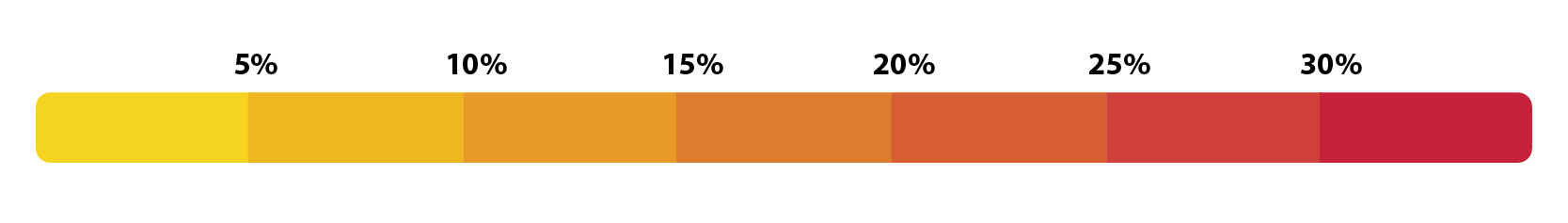

Consumers in every state will experience premium rate increases and, if they don’t have help from an employer or from premium tax credits, will bear the brunt of an average increase of nearly 20% to their health insurance premiums in 2026. For individual marketplace enrollees in states like Delaware, New Mexico, and Mississippi, average rate increases will exceed 30%. To see how much rates could increase in your state, take a look at this map or the corresponding table.

Average Proposed Health Insurance Premium Rate Increases by State, (effective January 1, 2026)

*This premium rate has been finalized and will go into effect January 1, 2026. Other states’ rates are subject to change prior to finalization.

Average Proposed Health Insurance Premium Rate Increases by State, (effective January 1, 2026)

*This premium rate has been finalized and will go into effect January 1, 2026. Other states’ rates are subject to change prior to finalization.

And these are just the average rates in each state. Some insurers have proposed rate increases as high 66.4%, doubling or even tripling the rates of other insurers in the state. As insurance companies jack up prices, enrollees will be forced to swap plans during the upcoming Open Enrollment period beginning on November 1. Enrollees will also be forced to find a new plan if their insurance company opted to pull out of the federal health insurance marketplace entirely, like Aetna.

The Open Enrollment period will be even harder to manage this year, as the Trump administration shortened the amount of time for people to enroll, and also cut back on enrollment assisters and navigators that aim to make the process easier. These changes will make it harder for millions of Americans to find an affordable plan, and many will go without insurance coverage entirely.

Triple Threat to Coverage

We previously discussed the factors that contribute to the proposed rate hikes. But increases to premium prices aren’t the only factor impacting consumers’ ability to obtain marketplace coverage for themselves and their families. Two other significant threats to enrollment are occurring simultaneously:

- The Marketplace Integrity and Affordability Rule is slated to go into effect as millions of consumers across the U.S. begin to experience the sticker shock of shopping for a marketplace plan in 2026. This rule, which increases income verification measures for marketplace enrollees and places restrictions on automatic re-enrollment processes (discussed in more detail here), is estimated to cause between 725,000 and 1.8 million people to lose or forego marketplace coverage.

- Furthermore, if Congress does not act by the end of the year to extend the enhanced premium tax credits, an estimated 2.2 million people will also lose marketplace coverage. In 2025, these enhanced tax credits assisted more than 19 million people across the United States with their health insurance premiums. If Congress fails to extend the enhanced tax credits, the actual cost a shopper pays for marketplace insurance will increase by even more than the proposed rates shown above.

Taken together, these factors are projected to reduce enrollment by millions in 2026 and start the “death spiral” that forces insurers to raise prices further to re-coup lost premiums, leading more young and healthy individuals to forego health insurance altogether and continuing the cycle.

How much more?

The exact price for a health insurance plan on the marketplace will vary depending on consumers’ ages, where they live and their income. Below are hypothetical examples of how, premium hikes and enhanced tax credit expiration could impact some families.

| Person/Family | 2025 Premium (for a typical silver plan, no enhanced tax credits)i | 2025 Premium (with enhanced tax credits) | Proposed 2026 Premium (no enhanced tax credits)1 | Total increase in monthly premium cost2 |

|---|---|---|---|---|

| 60-year-old making $65,000 in Maine | $1,108/month | $460/month | $1,374/month | $914/month |

| 45-year old couple making $85,000 in Colorado | $988/month | $602/month | $1,269/month | $667/month |

What’s next on this issue?

CMS will review these proposed rates and decide whether to give insurers approval to sell them to consumers on the marketplace beginning November 1st (the start of open enrollment).

Consumers and their advocates have a short opportunity for providing feedback to CMS and their state insurance regulators if they think the rate increases are unreasonable. The rate filing instructions also contemplate that Congress could extend tax enhanced tax credits – but stresses that insurers would then submit corrections by mid-September, in time for the marketplace open enrollment. CMS is scheduled to announce the final rates by October 31, 2025.

CMS could choose to approve rates as proposed or finalize rate increases lower than the proposed rates. Consumers should be wary of actions that might appear to lower their premium rates but actually increase their out-of-pocket costs – for example, CMS or insurers could finalize smaller rate increases but simultaneously decrease the actuarial value of the plan’s coverage. This could mean higher co-pays or deductibles or even cuts to some services and benefits. Families USA will keep a close eye on this issue and continue to monitor the rates as the Open Enrollment Period approaches.

Call to Action

Congress can bring immediate relief to consumers this year by taking action NOW to make the health insurance premium tax credits permanent. Now is the time to call on Congress to demand they extend these tax credits and help lower health care costs for Americans.

Footnotes:

i https://www.kff.org/interactive/subsidy-calculator/

1 Obtained by multiplying the 2025 Premium (in this table) by the proposed insurance rate increases (in the table above).

2 Proposed 2026 Premium subtracted by the 2025 Premium with tax credits.